unemployment tax refund update september 2021

September 09 2021. Hello so I looked at my IRS account transcript and noticed that theres a tax code 290 reading Additional tax assessed with a date of 7-26-2021.

Still Waiting On Your Tax Refund Here S What To Do Sep Experian Experian

The Bureau of Economic Analysis has released new data showing that in the second quarter of 2021 April to June GDP increased at an annual rate of 66 percent.

. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the American Rescue Plan Act of 2021 ARPA which allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. As such the IRS estimated that up to 13 million Americans would be eligible for a tax refund. By Minnesota News Network 2021-09-13T055454-0500 September 13th 2021 State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments.

If you lost your job during the pandemic the American Rescue Plan extends certain pandemic-related programs through September 6 2021. 4th Stimulus Check Update. Monthly payments are issued automatically on the 15th of each month beginning in July and ending in December.

Anyways I still havent received my unemployment tax refund and there hasnt been any kind of mention regarding a. Some social media users on Twitter and in Facebook groups who have been monitoring the payments said. There is an explanation for the IRS delays.

IRS Unemployment Tax Refund 10 September 2021 IRS unemployment tax refund 2021 About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How. It will then adjust returns for those married-filing-jointly taxpayers who are eligible for the up to 20400 tax breakIf the IRS determines you are owed a refund on the unemployment tax break it will automatically send a checkYou dont need. Eligible recipients of an elusive tax refund related to unemployment compensation lit up with joy over the holiday weekend with reports that some have finally started to see the checks roll in.

This comes after a real GDP. For the exact amount and record of your payments visit the IRS Child Tax Credit Update Portal. Here are some of the ways that you could benefit.

The delay has been exacerbated by people. From my knowledge this means that theyve audited my account and I dont owe anything. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. According to Collins the IRS processed 13 million taxpayer accounts through September 3 to reflect the changes resulting in either a refund or an adjusted tax balance. The 10200 is the maximum amount that can be excluded when calculating taxable income.

July 29 2021 338 PM. You will need to claim the remainder of the credit on your 2021 tax return for a lump sum refund. The American Rescue Plan Act of 2021 ARP excluded up to 10200 in unemployment compensation per taxpayer paid in 2020 the IRS explains.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. In total 1358 million returns were processed in 2021. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release.

Now the third round of these payments - after. Thats the good news. Federal unemployment benefits FPUC at 300 per week on top of state benefits.

You did not get the unemployment exclusion on the 2020 tax return that you filed. The amount of tax returns processed by tax day for 2020 was down 10 million from the year before. Actualizado 02092021 - 1307.

Internal Revenue Service IRS - September 2. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true.

Where S My Refund Home Facebook

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

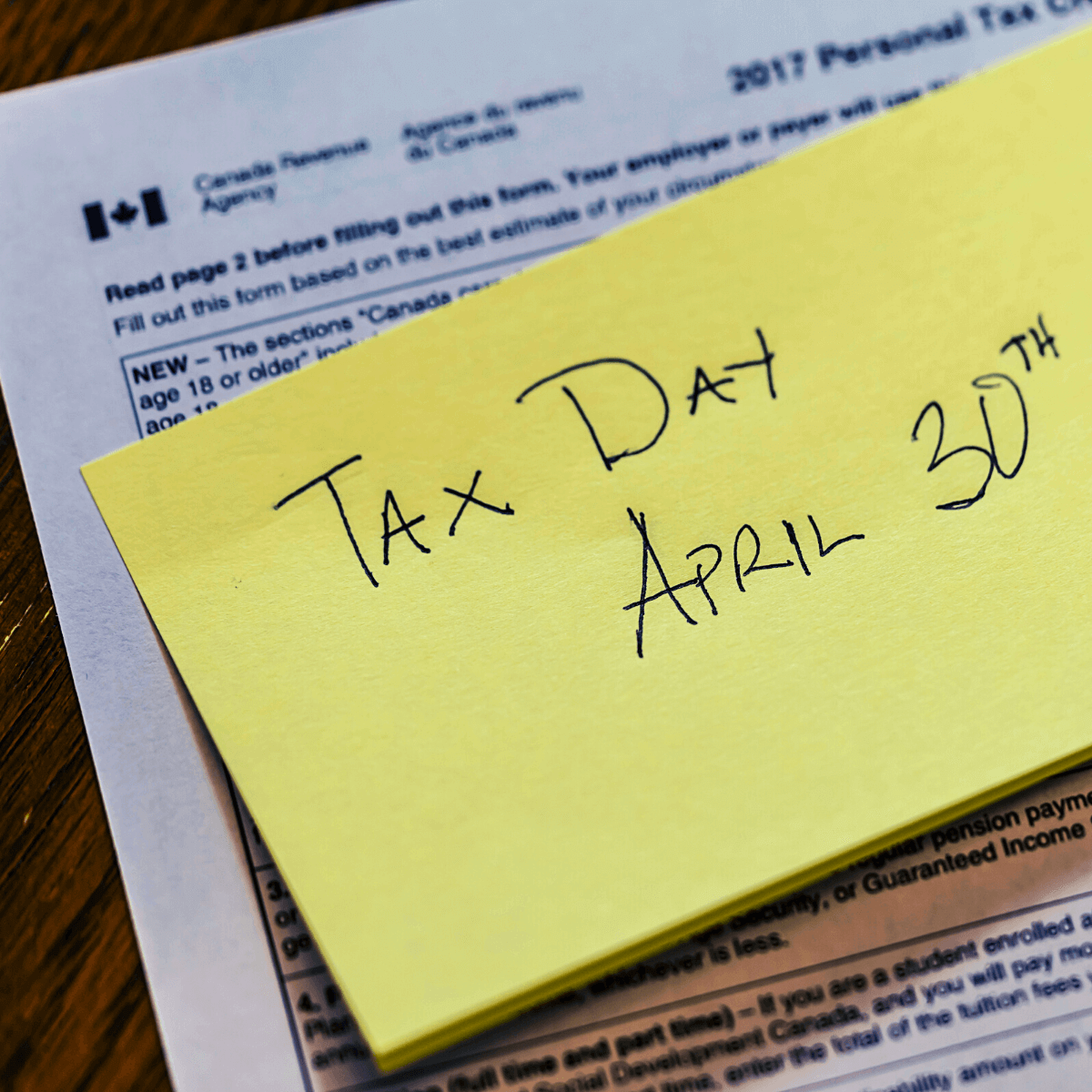

Canadian Tax Return Deadlines Stern Cohen

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

Does Your Teenager Need To File An Income Tax Return

One Time Extra Benefit Payments Additional Benefits For Individuals In Response To Covid 19 2022 Turbotax Canada Tips

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

2022 Personal Tax Season What S New For 2021 Tax Returns

You Won T Believe What Just Happened Will This Lead To New Changes

![]()

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

T2209 Tax Form Federal Foreign Tax Credits In Canada 2022 Turbotax Canada Tips

Americans Should Be Prepared For A Smaller Tax Refund Next Year

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

Stock Market Crash 15 Stocks To Weather A 14 Drop In S P 500 From Morgan Stanley Business

Canada Total Income Taxes Paid By Type Statista

Social Security What S The Magic Age Tax Deadline Payroll Taxes Federal Income Tax

5 Things You Should Know If You Were Suddenly Unemployed This Year H R Block Canada